雙贏財(cái)務(wù)|加計(jì)抵減,您報(bào)對(duì)了嗎?

作者: 本站 來(lái)源: 本站 時(shí)間:2021年02月24日

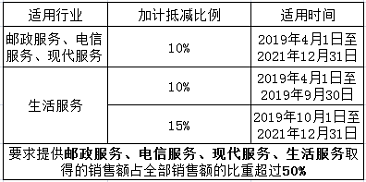

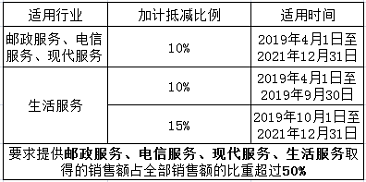

加計(jì)抵減,您報(bào)對(duì)了嗎?加計(jì)抵減,是指生產(chǎn)、生活性服務(wù)行業(yè)增值稅一般納稅人在當(dāng)期可抵扣進(jìn)項(xiàng)稅額基礎(chǔ)上分別再加計(jì)10%、15%抵減應(yīng)納稅額.

納稅人應(yīng)按照當(dāng)期可抵扣進(jìn)項(xiàng)稅額的10%或者15%計(jì)提當(dāng)期加計(jì)抵減額。按照現(xiàn)行規(guī)定不得從銷項(xiàng)稅額中抵扣的進(jìn)項(xiàng)稅額,不得計(jì)提加計(jì)抵減額;已計(jì)提加計(jì)抵減額的進(jìn)項(xiàng)稅額,按規(guī)定作進(jìn)項(xiàng)稅額轉(zhuǎn)出的,應(yīng)在進(jìn)項(xiàng)稅額轉(zhuǎn)出當(dāng)期,相應(yīng)調(diào)減加計(jì)抵減額。計(jì)算公式如下:

當(dāng)期計(jì)提加計(jì)抵減額=當(dāng)期可抵扣進(jìn)項(xiàng)稅額×10%(15%)

當(dāng)期可抵減加計(jì)抵減額=上期末加計(jì)抵減額余額+當(dāng)期計(jì)提加計(jì)抵減額-當(dāng)期調(diào)減加計(jì)抵減額

當(dāng)期可抵減加計(jì)抵減額全部結(jié)轉(zhuǎn)下期抵減抵減前的應(yīng)納稅額大于零,且大于當(dāng)期可抵減加計(jì)抵減額當(dāng)期可抵減加計(jì)抵減額全額從抵減前的應(yīng)納稅額中抵減抵減前的應(yīng)納稅額大于零,且小于或等于當(dāng)期可抵減加計(jì)抵減額以當(dāng)期可抵減加計(jì)抵減額抵減應(yīng)納稅額至零。未抵減完的當(dāng)期可抵減加計(jì)抵減額,結(jié)轉(zhuǎn)下期繼續(xù)抵減。加計(jì)抵減政策執(zhí)行到期后,納稅人不再計(jì)提加計(jì)抵減額,結(jié)余的加計(jì)抵減額停止抵減。

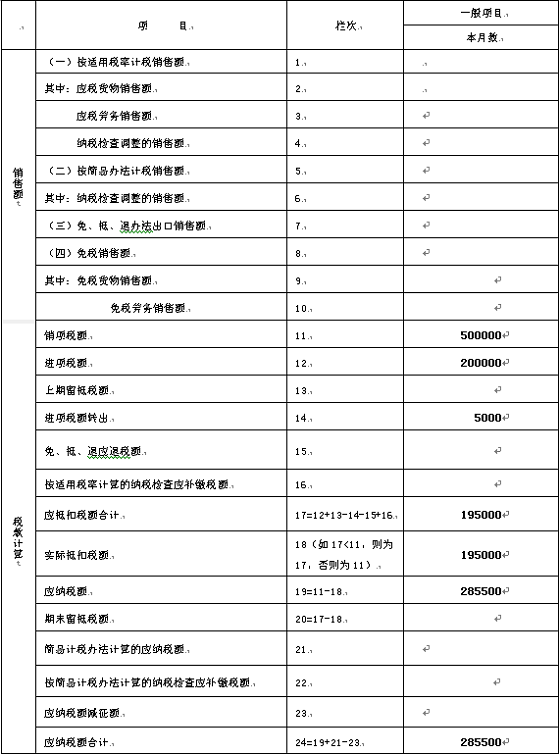

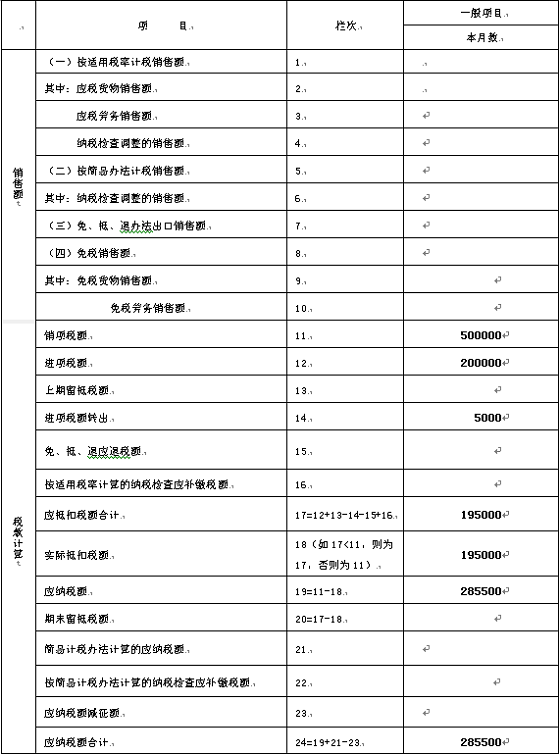

納稅人發(fā)生加計(jì)抵減的,應(yīng)先填報(bào)《增值稅納稅申報(bào)表附列資料(四)》(稅額抵減情況表)——“加計(jì)抵減情況”,申報(bào)系統(tǒng)能根據(jù)加計(jì)抵減情況、抵減前的應(yīng)納稅額自動(dòng)計(jì)算抵減后的應(yīng)納稅額。小藍(lán)企業(yè)是一家主營(yíng)現(xiàn)代服務(wù)的企業(yè),符合加計(jì)抵減的條件,2020年8月所屬期發(fā)生了銷項(xiàng)稅額500,000元,進(jìn)項(xiàng)稅額200,000元,進(jìn)項(xiàng)稅額轉(zhuǎn)出5,000元(前期已計(jì)提加計(jì)抵減),加計(jì)抵減期初余額為0,那么小藍(lán)企業(yè)的本期實(shí)際抵減額是多少呢?應(yīng)納稅額是多少呢?

(1)加計(jì)抵減本期發(fā)生額=200,000×10%=20,000元加計(jì)抵減本期調(diào)減額=5,000×10%=500元加計(jì)抵減本期可抵減額=0+20,000-500=19,500元(2)本期“抵減前的應(yīng)納稅額”=500,000-(200,000-5,000)=305,000元(3)加計(jì)抵減本期可抵減額19,500元<本期抵減前的應(yīng)納稅額305,000元 因此,加計(jì)抵減本期實(shí)際抵減額=19,500元(4)應(yīng)納稅額=500,000-(200,000-5,000)-19,500 =285,500元增值稅申報(bào)表填表參考文件:國(guó)家稅務(wù)總局公告2019年第15號(hào)附件2:《增值稅納稅申報(bào)表(一般納稅人適用)》及其附列資料填寫(xiě)說(shuō)明.

增值稅納稅申報(bào)表(適用于增值稅一般納稅人)

增值稅納稅申報(bào)表附列資料(四)

(稅額抵減情況表)

當(dāng)企業(yè)當(dāng)期發(fā)生進(jìn)項(xiàng)轉(zhuǎn)出時(shí),申報(bào)的進(jìn)項(xiàng)稅額計(jì)算得出的加計(jì)抵減發(fā)生額需全額填列附表四加計(jì)抵減項(xiàng)目“本期發(fā)生額”,進(jìn)項(xiàng)稅額轉(zhuǎn)出計(jì)算得出加計(jì)抵減調(diào)減額也需全額填列附表四加計(jì)抵減項(xiàng)目“本期調(diào)減額”,而不能用實(shí)際抵扣稅額乘以加計(jì)抵減率直接填列加計(jì)抵減項(xiàng)目“本期發(fā)生額”喔!

來(lái)源:廣州稅務(wù)

![]()

![]()

![]()

湘公網(wǎng)安備 43010202001085號(hào)

湘公網(wǎng)安備 43010202001085號(hào)